|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding No Cost Refinance Rates: Key Features and HighlightsNo cost refinance rates have become an attractive option for homeowners looking to refinance their mortgages without the burden of upfront fees. This financial maneuver can potentially save you money while allowing you to take advantage of favorable interest rates. What Are No Cost Refinance Rates?No cost refinance rates refer to a refinancing option where the lender covers the closing costs associated with the mortgage refinancing process. These costs can include application fees, title insurance, and appraisal fees. The term 'no cost' can be somewhat misleading, as these fees are often recouped by the lender through a slightly higher interest rate. Advantages of No Cost Refinance

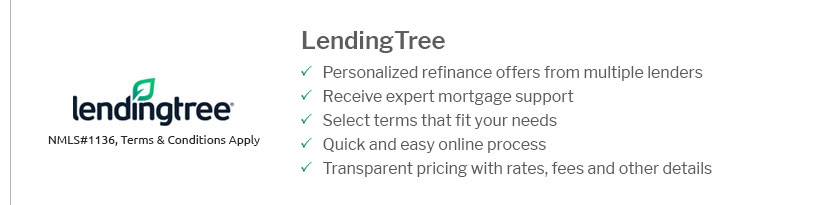

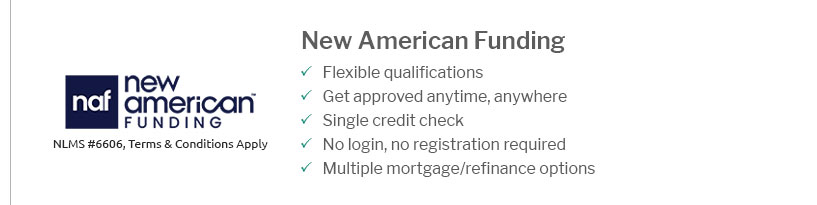

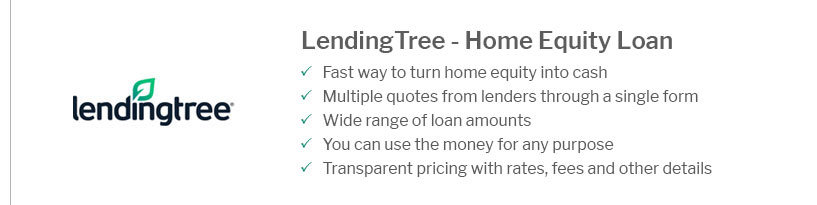

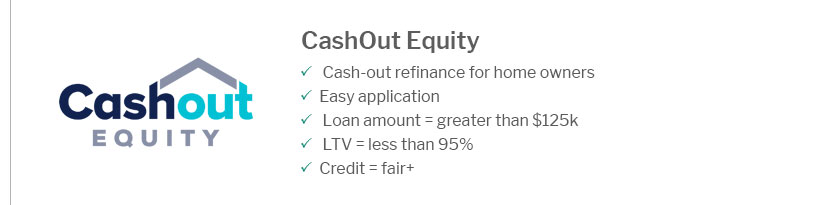

Considerations to Keep in MindWhile no cost refinance rates are appealing, it is essential to consider the higher interest rate. Calculate the overall cost to ensure that this option is truly beneficial for your financial situation. How No Cost Refinance WorksThe mechanics behind no cost refinance involve shifting the lender's closing cost burden to the borrower through a higher interest rate. In essence, you are paying for the closing costs over time instead of upfront. This can be advantageous if you plan to keep the loan for a shorter period. Comparing LendersTo make the most of no cost refinance rates, compare different lenders. Check out options like top home equity loans to explore alternatives that may better suit your financial goals. Finding the Best RatesFinding the best no cost refinance rates requires diligent research and comparison. Consider factors such as the lender's reputation, customer service, and the overall terms of the refinance. Rate LockingWhen you find a favorable rate, consider locking it in to protect against market fluctuations. This strategy ensures you maintain the agreed-upon rate even if interest rates rise. To maximize your savings, you might also want to explore options like the best fha lenders in california for competitive rates and terms. FAQs About No Cost Refinance RatesWhat does 'no cost' mean in refinancing?No cost' means the lender covers the closing costs, but these are usually recouped through a higher interest rate over the life of the loan. Is no cost refinancing beneficial for everyone?No, it's best suited for borrowers who plan to move or refinance again in a few years, as the slightly higher interest rate might not be beneficial for long-term loans. How can I qualify for a no cost refinance?Qualifying typically involves having a good credit score, stable income, and sufficient equity in your home. https://www.columbiabankonline.com/personal-banking/mortgage-loans/no-fee-refinance

Want to Refinance Your Home With $0 Fees? View Rates - Home - Personal Banking - Mortgage Loans; No-Fee Refinance. https://money.usnews.com/loans/mortgages/articles/the-true-cost-of-a-no-cost-mortgage-refinance

What Is a 'No-Cost' Refi? - They can raise your mortgage rate (so they can absorb your closing costs) and give you a refinance loan amount equal ... https://firstmeridianmortgage.com/no-cost-refinancing/

For example, even if your current rate is 7%, refinancing to 6.625% at no cost is a smart move. After 180 days, if rates drop to 6.00%, refinance again, and ...

|

|---|